The Hottest Tech Ecosystem at Slush? (Hint, it's not Finland)

Seen as the younger brother to Estonia’s flourishing tech ecosystem, Lithuania has always been on the radar of founders and VCs alike, especially as a thriving hub for Fintech, with companies like TransferGo, kevin and Argyle leading the charge. However, recent developments suggest that the Lithuanian startup scene is experiencing a significant transformation. Is Lithuania on its way to becoming one of the next startup capitals of the Baltics?

In this piece, we will evaluate the Lithuanian ecosystem from the lens of a due diligence (DD) process. We will look at the traction (=ecosystem growth), the product (=exciting new startups), the market (=funds and angels), and the team (=great operators) to figure out if Lithuania is the star of the Nordics+.

An overview of the Baltics

Stellar traction

Lithuania’s tech ecosystem has witnessed a remarkable increase in exits, funding rounds, and an overall value increase of its startups. It has even outshone its larger counterparts in the Central and Eastern European (CEE) region, such as Estonia. Between 2017 and 2022, enterprise valuations of Lithuanian startups have grown by a factor of 16.6x. The ecosystem therefore grew at roughly five times the rate of Estonia (where valuations grew by 3.1x) and four times the CEE average of 4.2x in the same period.

Beyond the now-established names such as Vinted and Nord Security (with the former exploring IPO plans), the next wave of unicorns is waiting on the doorstep. Companies such as PVcase, CAST AI and Citybee offer promising trajectories to soon join the ranks of Lithuanian unicorns.

Lithuania’s ecosystem has also already shown that it can not only serve as a startup incubator but also produce successful exits. These developments have catapulted Lithuania to the forefront of the Eastern European startup scene. In the graphic below, we explore Lithuania’s most significant exits and valuations to date.

Successful exits and valuations of Lithuanian tech companies

Fantastic product

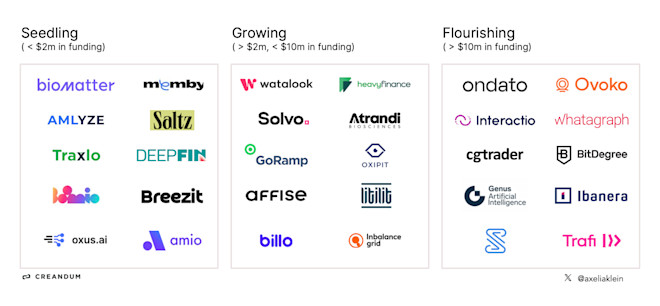

The Lithuanian startup landscape is evolving rapidly, attracting not only local but also international attention. Looking at various funding stages, we picked out companies that have caught our attention recently.

Biomatter

Founded in 2018, Biomatter made it its mission to develop new proteins that can be applied in medicine and manufacturing through its AI platform. The company has a total of five co-founders Laurynas Karpus, Donatas Repecka, Vykintas Jauniskis, Irmantas Rokaitis and Rolandas Meskys with vast experience in biochemistry. The combination of this expertise and vision has helped them attract funding from one of Lithuania’s top early stage investors, Practica Capital.

Saltz

Focused on bringing fresh and fairly priced ingredients to restaurants and hotels, Saltz is one of the most exciting companies to watch in the FoodTech space. The small team of 7 is headed by co-founders Tomas Slimas and Reinis Strodahs and boasts experience from Shopify, Oberlo and Xentral. Although still quite young, Saltz already counts some of Lithuania’s top restaurants and hotels among its customers.

Watalook

With the goal to provide an all-in-one management solution for beauty professionals, Watalook was founded by the team surrounding Klaudijus Ambrozas and Justas Vitenas in 2020. Watalook has raised a seed round from Startup Wise Guys, Practica Capital and Danish early stage investor byFounders.

Ondato

Ondato is another interesting company already ahead of the others with more than $11M in funding. The company was founded by Andre Vistorskijj and Liudas Kanapienis and tackles the increasingly important issue of anti-money laundering, KYC and KYB. Ondato adds to the number of fintechs coming out of Lithuania.

Promising Startups in Lithuania

Captivating market

Despite an impressive number of bootstrapped companies, smaller investors and venture funds providing startups with capital have played a pivotal role in fostering the growth of Lithuania's startup scene. The country has seen a surge in early-stage investors and accelerators dedicated to nurturing and supporting startups.

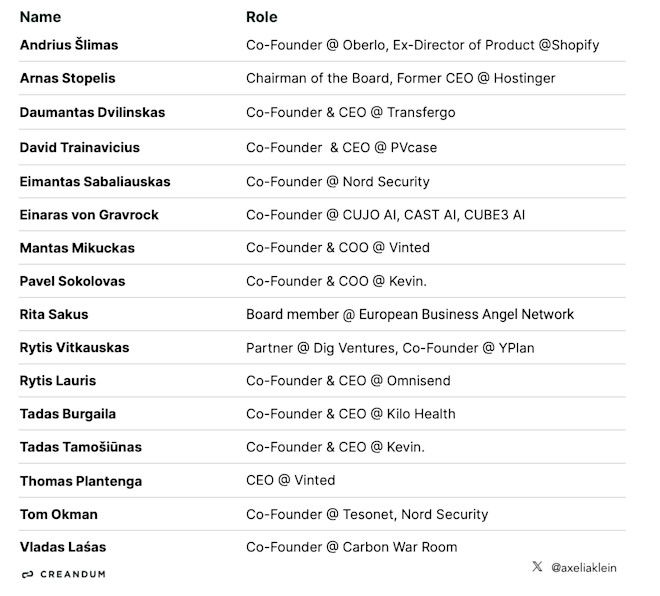

As in many other countries, angel investors and networks play a pivotal role in fostering a thriving ecosystem and they often come from the country’s most successful startups. In Lithuania’s case they come from Vinted, Kevin, PVCase or Nord Security.

Lithuania’s Business Angels Fund, the Business Angels Network, Baltic angels syndicate BAD.ideas, as well as other experienced investors are supporting Lithuanian startups. It is clear that successful Lithuanian entrepreneurs are willing to give back to the ecosystem and help it grow. Below, we explore a number of those entrepreneurs and angel investors who have supported many Lithuanian companies.

"There's a palpable sense of optimism and a collective belief that tomorrow can be better. This optimism is not just refreshing but necessary for pioneering a better future. It's this positive outlook, coupled with relentless ambition, that propels Lithuanian startups forward." Einaras von Gravrock

Founders and angel investors in Lithuania

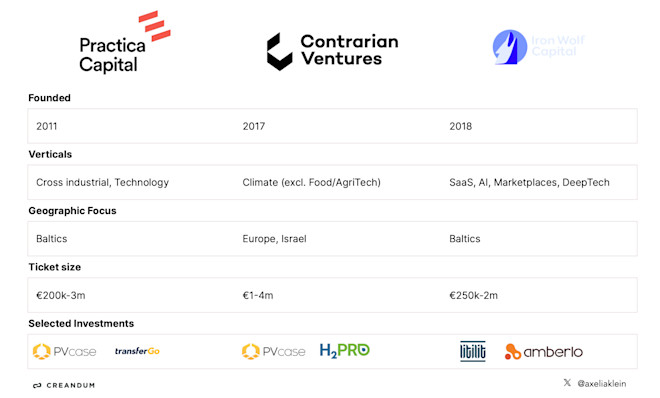

Besides angel investors and entrepreneurs, investors such as Contrarian Ventures, Practica Capital, Iron Wolf Capital, as well as Latvia-based Change Ventures are leaving their mark in the ecosystem. Mainly focused on the early stages, they provide Lithuanian startups with money for Pre-Seed, Seed and Series A funding.

Institutional Investors

While the majority of early stage funding is provided by local investors, more and more European and top US-based investors are flocking to Lithuania for follow-on rounds. 2022 and 2023 saw some of the biggest rounds in Lithuanian history with large raises by NordVPN, PVcase and CAST AI.

Recent significant funding rounds

Great team

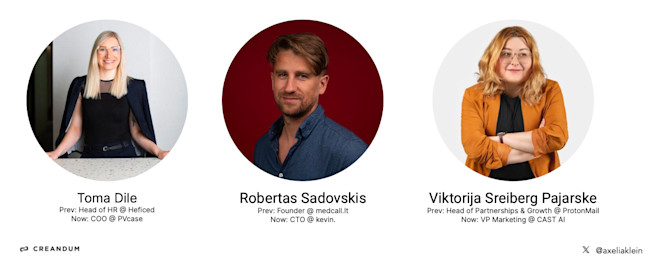

Looking at the Lithuanian ecosystem, it becomes clear: there is talent all around. As seen in other countries, early startup ecosystems benefit from the first successful entrepreneurs and operators - their hands-on knowledge and experience is infectious.

Lithuanian operators

Results

Lithuania's startup ecosystem has recently been showing tremendous growth, with impressive funding rounds and successful exits. This is underpinned by local and international venture funds, but even more so Lithuanian angel investors and founders who are giving back to the ecosystem. Connecting this with an abundance of talent and great operators, the ecosystem is gaining momentum. Like any good DD, we have found no 'red flags' and anticipate the Lithuanian tech scene to take a central position in the wider European ecosystem in the future.

P.s... are you going to Slush? If you're as excited about Lithuania's burgeoning startup scene as we are, why not join the conversation? Slush, one of the leading tech conferences in the region, is an excellent opportunity to connect with the key players in the Lithuanian ecosystem. Let us know if you'll be there, and be part of this exciting journey as Lithuania forges ahead to become the next startup capital of Eastern Europe.

Co-authored by Beata Klein and Paul Neufanger.

A special thanks to Tom Okman, Rytis Vitkauskas, Leon Kuperman, Einaras V, Inga Langaite and Enrique S for their contributions.