20 years of Creandum

When we started Creandum in 2003, the European opportunity was not what it looks like today. There were few real venture investors, most entrepreneurs and VC’s didn’t think it was possible to build global tech companies from Europe and the US’ share of global venture investment was dominant. Little did we know that by 2023, we would have opened hubs in Stockholm, Berlin, London and San Francisco, Creandum’s funds have raised 1.7bn USD and invested in more than 130 companies at Seed and Series A. Today, we are proud that one in six companies in the portfolio is a unicorn, including Spotify, Depop, iZettle, Bolt, Trade Republic and Klarna.

In our research report in collaboration with Dealroom, in the last 20 years we have seen Europe’s share of global venture capital investment increase from ~5% to 20%, with seed now taking a 30% share. Europe has the highest density of unicorn tech hubs in the world, with role model entrepreneurs such as Daniel Ek (Spotify), Daniel Dines (UiPath), Nikolay Storonsky (Revolut), Sebastian Siemiatowski (Klarna) and many more as inspiration. The European continent houses more than 600 million people, creating a massive volume of talent. This all highlights Europe’s stellar position to take a leading role in creating global tech leaders.

The Creandum journey — starting in 2003 and now one of the leading early-stage venture capital firms in Europe, has not been without challenges and has required an extreme amount of effort from past and present team members, the funds’ LPs, advisors and most importantly the entrepreneurs we have partnered with along the way. In this piece, we look back at key milestones in the Creandum story to date, reflect on their impact and collect learnings for the next 20 years.

Team Creandum minus a few rockstars 👀

Creandum’s first fund and daring LPs (2003)

There was a time when European VC was an asset class that not only received very little allocation but was also frowned upon by many LP’s. Creandum’s first fund was cornered by the Swedish Pension Fund AP6 and Swedish life insurance company Skandia. Not only were they forerunners at the time but they have since then invested in every Creandum fund. The first fund was relatively small, with EUR 40m split equally between the two. Despite numerous discussions, no other LP joined the fund. It was not a glorious time to be a venture investor in Europe but the journey had started 💪

Meeting Spotify in 2007

Fredrik Cassel, Investment Manager at the time (and btw Creandum’s first ever analyst hired in November ’03), first heard of Spotify at a recruiting event at KTH, The Royal Institute of Technology. After a period of negotiations that extended more than a year with the company’s two co-founders, Daniel Ek and Martin Lorentzon, the Creandum fund co-led the company’s Series A in 2008. Although a historically challenging space for investments (at the time, people were lamenting the death of the music industry and that piracy had won), it was clear to us that Daniel and the uniquely qualified team were people we should back. Daniel’s vision, to change the music industry forever by building a product that was better than piracy, and his global ambitions truly changed the European outlook on what is possible for an entrepreneur. And that a global tech winner could be built from Europe.

At a board dinner, just as the company was celebrating the seemingly unachievable milestone of reaching 1 million monthly active users, Fredrik vividly remembers his jaw dropping to the floor when Ek said they could reach 100m. This level of ambition and pushing the limits was an eye-opener for us. Another memory was being shown the Spotify mobile product for the first time in 2009, and being in awe of its revolutionary speed and snappiness, seamlessly streaming music going straight into your headphones. All the music in the world, also available on the go! This product was intended to become an addiction to its users and 15 years later it is fair to say that hundreds of millions around the world are addicted. Fredrik reflects on the Spotify investment in his piece from 2018, ‘Inside the Dusty Brains of the First Backer of Spotify’.

Straight from the Spotify press kit in 2008

iZettle (2010)

At Creandum, one of our core beliefs is to back amazing individuals. An inspiring example of this are the iZettle founders, Jacob de Geer and Magnus Nilsson. Although eventually iZettle was acquired by PayPal for $2.2bn in 2018, at first the proposition was scolded by the market. When they first presented mobile micro-payment devices to customers, people did not believe this would work — if it was indeed possible, it would be in use by now. These are the kinds of entrepreneurs we love at Creandum — people who don’t take ‘no’ for an answer and who relentlessly pursue their dreams.

Only a few years later, iZettle was powering small businesses across continents, allowing people to take payment on the move. The Creandum fund participated in the Series A round — we were ‘wowed’ by their marketing video which was released in the run up to the funding round. Johan Brenner, one of the Creandum’s General Partners, led the work with the investment in iZettle — in an article from the archives, read his interview with Magnus Nilsson, iZettle co-founder and COO from 2017.

The iZettle founders

Launching in the US (2012)

Creandum’s first hub outside of the Nordics was in Silicon Valley. Johan was the GP in charge of setting it up, with the ambition that Creandum could be more of a helpful partner to the Creandum funds’ portfolio companies by having boots on the ground in the most important technology ecosystem in the world. Today this remains a key differentiator for Creandum as one of the few early-stage European VC firms with a hands-on presence on the US west coast. We help portfolio companies commercially scale into the US, raise downstream growth capital from top investors, export talent into Europe and much more.

Johan a k a Captain America taking the US by storm!

Our General Partner Carl Fritjofsson has run the US hub since 2016. He initially worked for us as an Associate in Stockholm, wrote the fund III ppm and left for San Francisco as co-founder of Creandum fund portfolio company Wrapp.

In addition to being a link for the European portfolio looking to go west, the Creandum funds are building out its US investing activities and has for many years been partnering with US companies with links to Europe. One such example is the grocery delivery company, Cornershop, founded by Swedish entrepreneur Oskar Hjertonsson. The Creandum funds’ invested in Cornershop’s Series A round in 2016 and the company was acquired by Uber in 2021 for an enterprise value of $3.5B. Other examples include neo4j, founded in Sweden but which moved its HQ to the US early on and raised $325m in 2021; and unitQ, founded by Christian Wiklund and which most recently raised $30m led by Accel.

Backing Depop (2015)

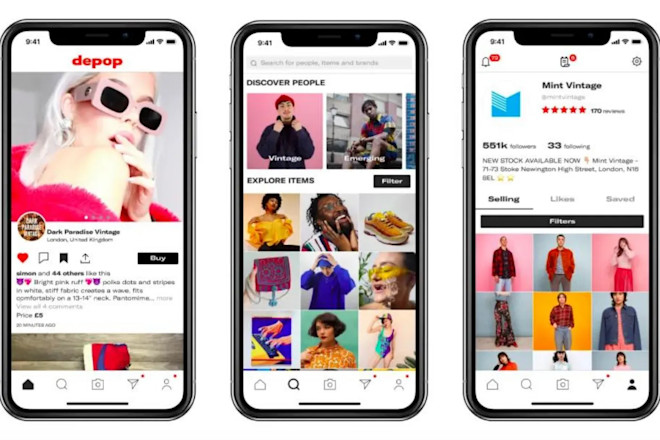

The Creandum funds invested in Depop’s Series A round in 2015. Depop is a community-powered marketplace, where buyers and sellers exchange fashionable clothes. London-based Depop was founded by Italian native Simon Beckerman in 2011 and since 2016 has been run by Maria Raga. At the time of the funds’ investment, the company had 150,000 daily active users (mainly Gen-Z influencers) with the potential for significant network effects.

The company grew exceptionally fast, and in June 2021 was acquired by Etsy for $1.6bn. Etsy, at the time of the announcement, described Depop as “the resale home for Gen Z consumers”. Fredrik, who led the funds’ investment in Depop, discusses the Etsy acquisition ‘Opening the hearts and wardrobes of Gen Z’.

Depop’s mobile app

Expanding to Germany (2016)

Simon Schmincke joined the firm as a Principal in 2014 — and had previously been at German VC firm Earlybird where he led their investment in the German neobank, N26. We knew Simon was the perfect fit for Creandum since we got to know him over the years before he joined us, as he was covering the Nordics in his previous role. Simon first started in Stockholm, bringing his family over for a year, where he immersed himself in the Creandum culture with Staffan, Johan, Fredrik, Daniel and the rest of the firm.

We had a strong belief that Simon and the people he would bring onboard would bring a different way of operating into the firm, challenging the way we run things, with a constant desire to improve. He opened our eyes to the opportunity in Germany, particularly in FinTech and has together with the team, built an impressive portfolio, including taxfix, lemon.markets, Tide, Swan and Billie. Simon was integral in building out the hub in Berlin, and later hired Peter Specht in 2017, who went on to make Partner in 2021 and is now heading our London hub.

Simon in the ‘old-new’ office in Berlin, with a 2 week Ikea delay

A Meeting with Johannes Schildt in 2016

We had been interested in digital health for some time, looking in particular for a European company which placed the consumer at the forefront of the proposition, with patience to know that disrupting such a regulated market takes time and that the right team may also come without longstanding healthcare experience. Fredrik had known Johannes Schildt for a number of years, but when they reconnected as Johannes had taken on the CEO role in Kry, a company he earlier had co-founded together with Josefin Landgård, Fredrik Jung-Abbou and Joachim Hedenius, all these expectations were met.

Kry has changed and matured over time, from outside challenger in the first years to a trusted partner to many nation’s healthcare systems today— such a juggernaut that even Sabina Wizander, at the time Investment Manager at Creandum and part of the Kry deal team, moved over to Kry to head up Business Development, before rejoining Creandum as Partner in June 2021.

Fredrik and Sabina with the Kry team, enjoying a ‘serious’ meeting

2018, the year of 3 significant exits

2018 was a big year for the firm. Spotify was one of the first companies globally to opt for a direct listing on the Nasdaq. Following Spotify, many other companies followed suit and listed directly. We say we always back innovation, regardless of sector, and this was another example. The direct listing was amplified across the global media — here is a piece in the Financial Times.

As all Swedes know, and perhaps some Swiss too, it can sometimes be challenging for people around the globe to properly distinguish the two countries

In May 2018, PayPal made its most significant acquisition to date when it bought iZettle for $2.2bn — just days before the company was planning on listing on Nasdaq Stockholm. The PayPal acqusition allowed iZettle to unlock PayPal’s 20 million merchants. The reason PayPal were so interested was iZettle’s coverage across Europe and Latin America, giving them a stronger global presence. CNBC covered the acquisition here.

At the end of 2018, Zynga acquired Helsinki-based games developer Small Giant Games, where the funds’ led the Seed round in 2014. Daniel Blomquist, now Operating Partner but a Partner in the investment advisory team at the time, had a particular affinity for the gaming sector, and this was one of the companies he advised and led the investment in. Zynga acquired Small Giant Games for over $1.2bn including earn-outs on the back of the top-grossing game Empire & Puzzles which to date has generated billions of USD in revenue and is highly profitable. More on Zynga’s acquisition here.

Johan and Daniel doing what they love best…

Trade Republic (2019)

Trade Republic was the first European mobile-only and commission-free broker — making trading and saving in stocks simple and intuitive. Before Trade Republic, there was little on the market for mobile-only brokerage accounts in continental EU. Although we cared that the offering was commission-free for the consumer, the service and product Trade Republic provided to its customers was even more important.

At Creandum, we believe in the power of beautiful products. We have specific Entrepreneurs in Residence who advise our founders on this — including our UX-expert Peter Ramsay and Felix Haas, our design specialist.

Johan Brenner, one of our General Partners, advised and led the investment in Trade Republic and even has personal experience of building something similar in the space many moons ago starting and selling a similar business to E*TRADE in the US! Trade Republic has had massive success and gone on to raise multiple rounds including a whopping $900m C-round led by Sequoia.

The Trade Republic founders

The future of Creandum and a new vertical — Climate

As we think about the future of Creandum, we are working with 6 different verticals, whilst always retaining a generalist outlook as you never know what’s around the corner. Our newest vertical is climate where the funds over the last couple of years have made a number of investments including Tesseract, founded by former ex-Revolut CRO, Alan Chang, whose mission is to accelerate renewable energy adoption around the world, Enode, an energy management system which connects users’ energy devices with a single API, and Monta, building the software infrastructure for EV charging.

As our report with Dealroom shows, the investment opportunity in Climate is significant, with the transition to net zero estimated to consist of approximately 20% of the world’s GDP. A key sub-area within Climate which is exciting for us is Electrification, where the Nordics is a leader and Europe has massive potential. We frequently host events centered around this vertical, and have regularly published our thinking, including the piece ‘The Growth and Future of Climate Tech Startups in Europe” in partnership with Speedinvest.

Our latest Electrification breakfast in Berlin, May 2023

Looking forward to the next 20 years

As we celebrate our 20th anniversary, we have chosen a few milestones of pivotal importance which helped turn Creandum into the firm we are proud to be a part of today. With an amazing team of nearly 40 people (of which 8 are Partners) including investors, talent, legal, marketing and so much more spread across our hubs, I could never have dreamed of the diverse and hard-working team we have built at Creandum. The team has grown fast in the last few years, but we have always worked hard to keep the ‘one firm’ culture across the firm.

Here at Creandum we’re not just busy finding the next global winner, we’re also all continuously building what we call the Creandum franchise. That means a firm that is not only successful for the next fund or two but rather one that will see generations of partners and team members come and go, with the brand and strategy intact. Or as Johan puts it, at Creandum you’re always a partner — you just go from being a General Partner to a Limited Partner.

Here’s to the next 20 years!